While the housing market has had its challenges in recent

years, there could be reason for optimism in 2012. Top housing economists

believe that the worst of the downturn may be over, and are predicting to see

gradual improvement in home sales and prices this year. Yet, a strong housing

recovery will require higher consumer confidence, improvement in the job

market, and an overall increase in the health of the national and global

economy. If these factors see

improvement, it is quite possible to see a gradual rebound.

Leslie Appleton-Young, Senior Vice President and Chief

Economist for the California Association of Realtors, spoke recently here in

Santa Barbara. She stated there are wild cards that could impact housing in

2012, including federal monetary and housing policies, a contentious political

climate in an election year, the happenings in Europe, and the unknown strength

of the U.S. economic recovery. She does, however, believe the California

housing market in particular will improve this year.

Appleton-Young sees a dichotomy between the number of people

who are in distressed situations with their homes, verses the number of people

out shopping, traveling, and buying cars. She thinks this disparity can be

explained by the number of individuals who are living in homes without paying

their mortgages, thereby allowing them to spend money on other things. She

referred to this additional wild card as the “squatter economy.”

On a national level, the economy is slowly gaining post-stimulus momentum. In 2011 the GDP was at 1.8%, and it is expected to be at 2.6% in 2012, which is still historically low, but it’s a definite improvement over where we have been, assuming the forecast is correct. These numbers are much better than our GDP from 2009, when we hit a low of -3.3%, the largest annual drop since 1938.

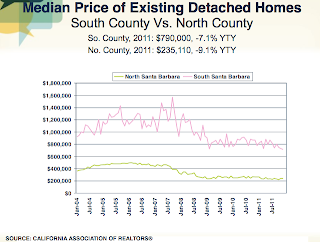

As always, it is important to remember that real estate is impacted by global and national events, yet it is inherently LOCAL. The data varies widely from one part of California to the next (i.e. Santa Barbara and Malibu), and we have to go even deeper than that. In Santa Barbara, we are divided by North and South County. Then we must consider individual neighborhoods and break that data apart by condos, homes/estates, land, and investment properties. And, these days we have to consider the type of sale.

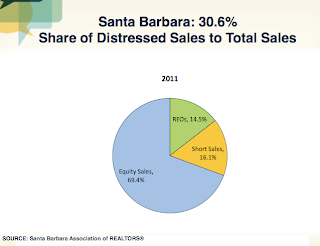

We have three very unique types of sales in the market

today. These include: Equity Sales (normal sales), Short Sales, and REO Sales

(bank-owned), which can be looked upon as their own sub-markets. Typically,

both Short Sales and REO Sales indicate that a property is distressed, and has

been or is currently “underwater,” meaning the loans on the property are higher

than the value of the property.

In California, 46.8% of sales are either REO or Short Sales,

and this number appears to be dropping (pre-foreclosure and auction properties

are down roughly 20% from one year ago). In Santa Barbara, 30.6% of our sales were distressed in 2011.

We have a much more traditional housing market when compared to many other

parts of California, where distressed sales are a much higher percentage of

overall sales.

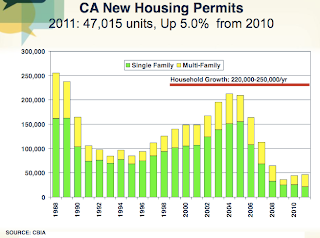

Housing sales were up 1.1% in 2011, compared to 2010. Housing permits were up 5%. Statewide, the median sales price was down 6.2%. Between the peak of California’s median home price in 2007 at $594,530 to the trough in 2009 at $245,230, we saw a 59% drop, which was unprecedented percentage to fall. The median has risen slightly since then, but it has been hovering nearby. Currently California as a whole has 4.2 months of unsold housing inventory. A 6-month supply is considered to be a balanced market. In Appleton-Young’s opinion, “The most likely scenario is for the modest recovery to continue, and this should push sales up slightly next year and maintain levels that are significantly higher than those recorded during the depths of the housing downturn.”

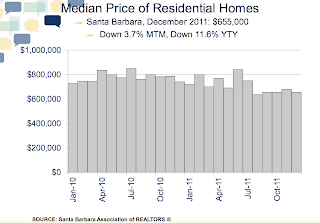

On the local front, the Santa Barbara South County median sales price was down 11.6% to $655,000, comparing 2011 to 2010, yet the number of sales went up 39.7%. December of 2011 reflected the highest number of sales in any month since May of 2007. This is suggested to be the result of low interest rates and the increase in affordability. The median price of detached homes (not including condos) was $790,000 in 2011, down 7.1% compared to 2010.

On a final note, I appreciated a commentary made recently by Adam Davidson of Planet Money. He gave a number of reasons for why there is room for growth, stating that when everyone is gloom and doom, there is room to boom. He mentioned numerous factors: There are 92 out of 100 people working. We have been through a suppressed housing market where a number of people are in smaller homes or living situations than what they feel comfortable with, and as soon as they feel wiggle room, we will experience those people requiring housing, and this will be based on real need. Corporations are sitting on large amounts of cash. Business investment is high. The United States is at the forefront of some of the best technologies the world has seen, including the Cloud, smart phones, “apps,” biotech, oil and gas, and IPO’s like Facebook. He said the lesson in these times is not to scour the world for which economist’s view is the “right” view, but to remember that thinking any particular view is “right” can be blinding and is what contributed to our current mess. We thought we were in a good place, when a downturn was right around the corner. Conversely, even though now many analysts lean toward predictions of gloom, we should remember that an upturn might very well be a possibility.

Is the worst

over? It looks like it. Are there wild cards? Yes. But sales are up, interest

rates are low, inventory is level, and Santa Barbara is an exceptional

community. We all need housing, and we are nearing spring, one of the more

robust times for our real estate market. Per Appleton-Young, it’s going to take

time to come out of this downturn, but we are improving one transaction at a

time. While no one knows for sure what will happen to the housing market in the

coming year, many analysts agree that things are getting better. If you have

been holding off buying a home, this may be the year to jump back into the

market while prices, interest rates, and overall affordability are highly in

your favor.

By Emily K. McBride

By Emily K. McBride

No comments:

Post a Comment